Accident

Whitfield County Schools offers an accident plan through Voya Financial to protect you from unexpected accidents, as it can be difficult to financially plan for the unexpected. This plan provides a benefit payable according to a schedule, and the funds may be used for any purposes, including helping to pay for medical out-of-pocket costs like deductibles and coinsurance. The expenses must result from an accidental injury.

This plan reimburses you for your actual medical expenses and the benefit is paid directly to you. Coverage options are available for you, your spouse, and your dependent child(ren). It also includes a benefit for death, loss of limbs, hospital visits, and transportation by ambulance – as a result of a covered accident. Reference the plan summary below for more details.

| Injury | Benefit |

|---|---|

|

Hospital Care

|

|

| Surgery - Open abdominal, thoracic | $1,000 |

| Blood, plasma, platelets | $500 |

| Admission | $1,250 |

| Confinement | $350 / day up to 365 days |

| Transportation | $650 / trip up to 3 per accident |

|

Lodging - Pet Boarding |

$150 / day up to 30 days $15 / day |

|

Accident Care

|

|

| Initial doctor visit | $75 |

| Urgent care | $200 |

| Follow-up doctor treatment | $75 |

| Medical equipment | $125 |

| Speech & physical therapy | $40 (up to 10 visits) |

| X-Ray and Lab | $60 |

|

Common Injuries

|

|

| 2nd and 3rd degree burns | $1,125 to $12,500 |

| Emergency dental work | $75 to $300 |

| Eye injury | $80 to $275 |

| Torn knee cartilage | $175 to $650 |

| Lacerations | $25 to $400 |

| Tendon, ligament, rotator cuff | $350 to $1,000 |

| Concussion | $200 |

| Paralysis | $7,500 to $20,000 |

|

Injuries - Dislocations

|

Non-Surgical | Surgical |

| Hip joint | $3,200 | $6,400 |

| Knee | $2,000 | $4,000 |

| Ankle or foot bones (other than toes) | $1,200 | $2,400 |

| Shoulder | $1,500 | $3,000 |

| Elbow, wrist | $900 | $1,800 |

| Finger | Toe | $250 | $500 |

| Hand bones, lower jaw, collarbone | $900 | $1,800 |

| Partial dislocations | 25% of the non-surgical benefit |

|

Injuries - Fractures

|

Non-Surgical | Surgical |

| Hip | $2,500 | $5,000 |

| Leg | $1,800 | $3,600 |

| Ankle, forearm, hand, wrist | $1,500 | $3,000 |

| Collarbone | $1,200 | $2,400 |

| Rib(s) | $350 | $700 |

| Shoulder | $1,500 | $3,000 |

|

Accidental Death

|

Common Carrier: - Employee: $100,000 - Spouse: $50,000 - Child(ren): $25,000 Other Accidental Death: - Employee: $50,000 - Spouse: $25,000 - Child(ren): $10,000 |

|

Sports Accident Benefit

|

|

| Covers accident as a result of an organized sporting activity | Pays an additional 25% of the Hospital Care, Accident Care, or Common Injuries to a maximum benefit of $1,000 |

Important Notes

- Employees and spouses are eligible regardless of age

- Coverage for eligible child dependent(s) is up to age 26

Exclusions

All sicknesses including pregnancy, services not medically necessary, being intoxicated in accordance with state laws, alcoholism, voluntary inhalation of gas/fumes/taking of poison, driving in any race or speed test or while testing an automobile or vehicle on any racetracks or speedway, injury while skydiving, hang gliding, parachuting, scuba diving, rodeo, or aviation except flight in a scheduled passenger aircraft, being under the influence of a narcotic/drug, intentionally self-inflicted injury, hernia, carpel tunnel syndrome, or any complication therefrom, bacterial infections.

Sports Accident Coverage

The Voya Accident plan pays an additional 25% of the Hospital Care, Accident Care, and Common Injuries benefits to a maximum of $1,000 if the covered accident is as a result of an organized sporting activity.

Vision

The Whitfield County Schools Vision Plan with MetLife provides a benefit for an exam and either eyeglasses or contact lenses. If you visit an in-network provider, you pay a copay for your standard eye exam / lenses, and the plan pays a benefit of up to $130 for frames and lenses on the Standard Plan and $200 on the Premium Plan. Additional copays apply for eyeglass lens options. Dependent children can be covered to age 26 regardless of their student status.

With the MetLife Vision Plan, you may visit any vision provider. However in order to maximize your vision benefit, we encourage you to visit an in-network provider. Participating vision provider information can be located at www.metlife.com/vision. Be sure to select the VSP Choice as the vision network.

| Vision Summary of Benefits (In-Network) | Standard Plan | Premium Plan |

|---|---|---|

|

Maximum Benefit per Calendar Year

|

Not Applicable | Not Applicable |

|

Exam

|

||

| Standard Exam | $20 copay | $20 copay |

| Contact Lens Fit and Follow-up | $60 copay | $60 copay |

|

Lenses - Glasses

|

||

| Single | Covered in full after $20 copay | Covered in full after $20 copay |

| Bifocal | Covered in full after $20 copay | Covered in full after $20 copay |

| Trifocal | Covered in full after $20 copay | Covered in full after $20 copay |

| Lenticular | Covered in full after $20 copay | Covered in full after $20 copay |

| Standard Progressive | $55 copay | $55 copay |

| UV Treatment | $0 copay | $0 copay |

| Tint | $0 copay | $0 copay |

| Standard Scratch Resistant Coating | $0 copay | $0 copay |

| Standard Polycarbonate - Adults | $31 - $35 copay | $31 - $35 copay |

| Standard Polycarbonate - Kids under 19 | $0 copay (up to age 18) | $0 copay (up to age 18) |

| Standard Anti-reflective Coating | $41 - $85 copay | $41 - $85 copay |

|

Frames

|

Plan pays $130 plus 20% off remaining balance | Plan pays $200 plus 20% off remaining balance |

|

Contact Lenses

|

||

| Conventional | Up to $130 allowance | Up to $200 allowance |

| Disposable | Up to $130 allowance | Up to $200 allowance |

| Medically necessary | Covered in full | Covered in full |

Frequencies

Standard:

-

Examination: Once per 12 months

-

Lenses: One pair per 12 months

-

Frames: One pair per 24 months

Premium:

-

Examination: Once per 12 months

-

Lenses: One pair per 12 months

-

Frames: One pair per 12 months

** Either eyeglasses or contacts are allowed per frequency **

SHBP Vision Benefit

If you are enrolled in a SHBP Medical Plan, the plan covers 100% at in-network providers of one routine eye exam every 24 months. The plan does not extend to additional vision benefits such as eyeglasses or contact lenses. Dilated retinal eye exams are covered at 100% at in-network providers once per calendar year.

Pet Insurance

Whitfield County Schools offers a pet insurance benefit through Nationwide. Employees enroll in pet insurance directly through Nationwide, but the premiums are conveniently deducted through payroll. My Pet Protection plan through Nationwide, offers you unmatched flexibility and peace of mind for your furry, feathered, or scaled companions.

With My Pet Protection, you have the freedom to use any veterinarian anywhere, at any time, with no need for pre-approvals or restrictive networks. Plans are not limited to dogs and cats; they extend to birds and exotic pets as well. The benefit has a low $500 annual deductible and a generous $2,500 or $5,000 annual maximum benefit, which renews in full each year. Prescription medications for your pets are covered, ensuring they receive the necessary treatments without financial worry.

Choose Your Coverage Level:

You can choose between two reimbursement levels: 50%, 70%, or 80% of your vet's invoice, ensuring that your out-of-pocket expenses are manageable.

Enjoy cashback benefits for a wide range of situations, including accidents, illnesses, hereditary conditions, and more. Whether it's a minor scrape or a major medical issue, My Pet Protection has your pet covered.

- 50% reimbursement

- 70% reimbursement

- 80% reimbursement

- Low $500 annual deductible

- $2,500 or $5,000 annual maximum benefit, which renews each year in full

Coverage Includes:

- Accidents and injuries

- Common illnesses (upset stomach, allergies, etc.)

- Serious illnesses (cancer, diabetes, etc.)

- Surgeries and hospitalizations

- Diagnostic tests (X-rays, MRIs, CT scans)

- Prescription medications, chemotherapy, and therapeutic diets

- Pet Rx Express for prescription medications

- Free, 24/7 access to VetHelpline for guidance on any pet health concern

- Lost Pet (due to theft) benefit

- Death of a pet benefit: $1,000

- Optional preventive wellness coverage: includes exam coverage and $500/year for flea, tick, and heartworm prevention medications after deductible and coinsurance

- Multi-pet discounts available

- 2-3 pets: 5% discount

- 4+ pets: 10% discount

What's Not Covered?

- Boarding

- Grooming

- Wellness

- Pre-existing conditions

How to Enroll?

The first question many pet parents ask is, “How do I sign up for my pet insurance benefit?” There are two easy ways for employees to enroll in a Nationwide pet insurance policy:

- Visit https://benefits.petinsurance.com/wcsga.

- Call (877) 738-7874 and mention that you are an employee of Whitfield County Schools.

Final cost varies according to plan, species, and zip code.

Additional Information

For more information on Whitfield County Schools Pet Insurance plans, please visit: https://www.petinsurance.com/resourcecenter/

Cancer Plus Critical Illness

Whitfield County Schools offers a Cancer Plus Critical Illness benefit through Voya Financial that provides a monetary benefit to help with the out-of-pocket medical and non-medical expenses upon diagnosis of a covered illness. Cancer Plus Critical Illness insurance helps you and your family maintain financial security during the recovery period of a serious medical event, such as cancer, heart attack, or stroke. This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. An infectious disease requires a minimum of 5 consecutive days confined in a hospital to be considered for reimbursement. Please refer to the Certificate for details.

Coverage amount for employees and spouses are available in $5,000 increments, as follows:

Employee: $5,000 to $30,000

Spouse: $5,000 to $15,000

- Spouses up to age 70 are eligible to elect this coverage

Dependent children, up to age 26, have the following coverage options available: $1,000, $2,500, $5,000, or $10,000. The employee must be enrolled in coverage to elect spouse or child coverage, but the dependent coverage levels can exceed the coverage elected on the employee. There are no health questions when enrolling in this benefit.

Additional information on the plan is below.

Features

- Benefits are paid in addition to any other insurance that you may have, and benefits are paid directly to you

- This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. (See certificate for complete details.)

- This product may pay multiple times for the same or different covered conditions (see the certificate on the Resources page for additional information)

- Benefits may be used however you'd like. Typical uses include:

- Out-of-pocket medical and non-medical expenses

- Home health care needs and home modifications

- Recovery and rehabilitation

- Child care or caregiver expenses

- Travel expenses to and from treatment centers

Wellness Benefit Included

The voluntary Critical Illness plan includes a wellness benefit for covered preventive screenings, including but not limited to:

- Chest X-Ray

- Mammogram

- Hemoccult

- Colonoscopy

- CA 125 and CEA blood tests

- Prostate specific antigen testing

- Women's wellness

Wellness Benefit Amount

- Employee: $50

- Spouse: $50

- Child(ren): $50

Simply submit your claim form along with proof of your screening to receive your screening benefit. Directions for submitting a claim are located on the Resources page.

| Covered Diagnoses |

|---|

| Heart attack | sudden cardiac arrest: 25% |

| Stroke | Coma |

| Cancer: 100% | skin cancer: 10% |

| Carcinoma in Situ: 25% |

| Coronary artery bypass: 25% |

| Major organ transplant / end stage renal failure |

| Permanent Paralysis |

| Diabetes - Type 1 |

| Severe burns |

| Transient Ischemic Attacks: 10% |

| Ruptured or dissecting aneurysm: 10% |

| Abdominal or thoracic aortic aneurysm: 10% |

| Open heart surgery for valve replacement or repair: 25% |

| Transcatheter heart valve replacement or repair: 10% |

| Coronary angioplasty: 10% |

| Implantable cardioverter defibrillator placement: 25% |

| Pacemaker placement: 10% |

| Benign brain tumor |

| Bone marrow transplant: 25% |

| Stem cell transplant: 25% |

| Loss of sight, hearing, or speech |

| Multiple Sclerosis, ALS, Parkinson’s Disease |

| Advanced dementia and Alzheimer’s Disease |

| Huntington’s Disease, Muscular Dystrophy |

| Addison’s Disease: 10% |

| Myasthenia Gravis, Systemic Lupus Erythematosus: 50% |

| Systemic Sclerosis: 10% |

| Occupational HIV or Hepatitis B or C |

|

Infectious diseases (covered at 25% unless otherwise noted) - COVID - Polio, rabies, meningitis, Lyme’s Disease - Mad Cow Disease - Flesh eating bacteria, MRSA, sepsis - Tuberculosis, bacterial pneumonia, diphtheria - Encephalitis, Legionnaire’s Disease, Malaria - Necrotizing Fasciitis, Osteomyelitis, Tetanus, Ebola * An infectious disease requires a minimum of 5 consecutive days confined in a hospital to be considered for reimbursement. |

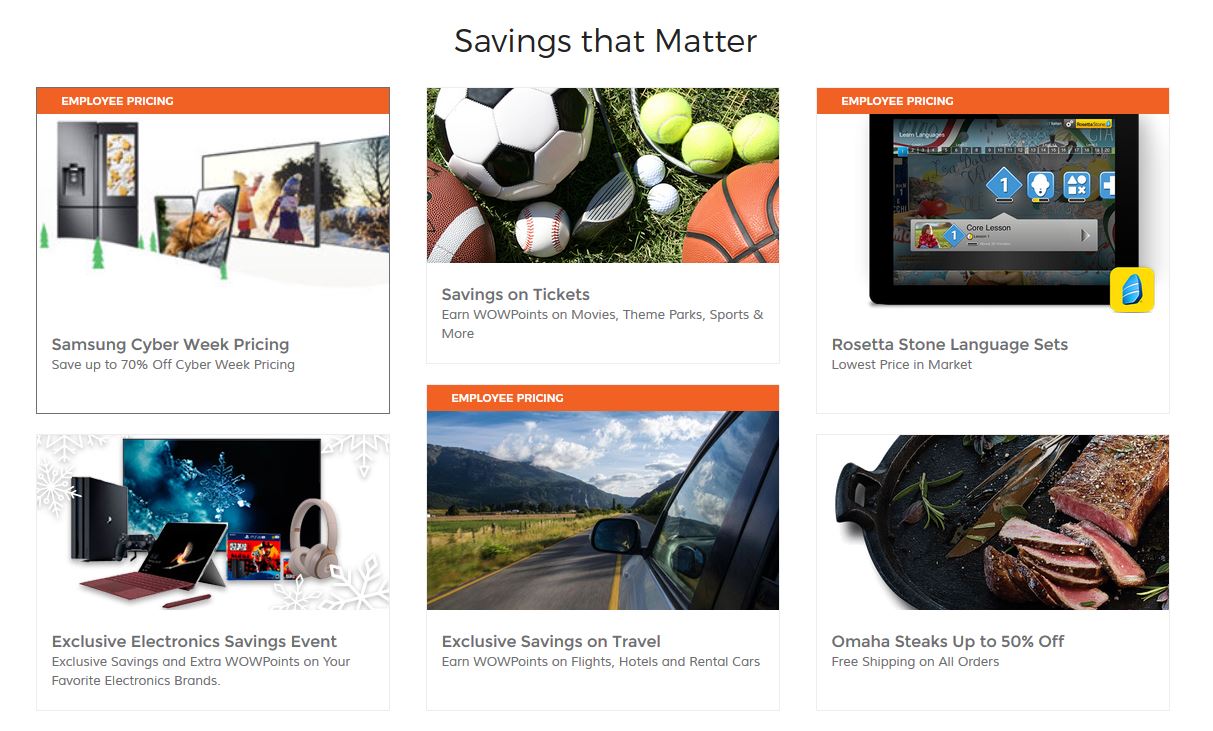

Perks at Work

Perks at Work is your exclusive employee discounts platform, designed to help save you money and time. With over 30,000 offers available, you can find the perks that matter to you, from everyday purchases to large special purchases.

Exclusive Savings

The Employee Pricing Program offers exclusive access to best-in-market pricing, and their unique relationship with brands allows them to provide such deep discounts to their network.

Perks at Work gives you access to 30,000+ national & local employee discounts and over 20 different categories ranging from Electronics, Home Appliances, Food & Groceries, Car Buying, Travel, Fitness, and more.

Community Online Academy (COA)

COA is a free resource of live and on-demand classes for both adults and kids from wellness to personal development. Join the community to get healthier, smarter, support each other and help those in need in 2021 and beyond.

Live Classes

There are 100+ free virtual courses for kids and adults, focused on learning and fun - taught by the highest quality teachers, instructors, and speakers from our community. Attend courses live on Thursdays or watch them on-demand - the courses are designed to fit into your unique schedule.

On-Demand Classes

Over 2,500 video classes on demand on dozens of topics:

- Kids: Coding Python, Drawing, Karate, Hip Hop Dance & more

- Wellness: Back Pain, Boxing Fitness, Dance, Cooking, Yoga Nidra, & more

- Thought Leaders: Negotiation, Leadership, Culture, & more

Personal Development

In the 21st century, the new competitive advantage is developing your people faster than others. Our technologies help build high-performance individuals, teams & organizations.

Offer Categories

The platform uses personalization to recommend offers that may be relevant to you in these categories:

- Travel – flights, hotels, car rentals

- Health and fitness

- Electronics, Tickets, and Restaurants

- Home and Garden, Flowers and Gifts

- Financial Wellbeing

Registration

- Visit www.perksatwork.com and click “Register for Free” at the bottom right hand corner of the page.

- Register by following the instructions to activate your account.

- You can also invite up to five friends and family members to share in the savings.

Savings That Matter

Employee Assistance Program (EAP)

Life presents complex challenges. If the unexpected happens, you want to know that you and your family have simple solutions to help you cope with the stress and life changes that may result. That’s why Whitfield County Schools is offering the Hartford’s Ability Assist Counseling Services to all of their employees. Their straightforward approach takes the complexity out of managing stress when life throws you a curve. Getting in touch is easy: simply call (800) 964-3577.

For the everyday issues like job pressures, relationships, retirement planning, personal grief, loss, or a disability, Ability Assist can be your resource for professional support. You and your family, including spouse and dependents, can access Ability Assist at any time.

Ability Assist Counseling Services

Emotional or Work-Life Counseling

Helps address stress, relationship or other personal issues you or your family members may face. It’s staffed by GuidanceExperts℠ – highly trained master’s and doctoral level clinicians – who listen to concerns and quickly make referrals to in-person counseling or other valuable resources. Situations may include:

-

Job pressures

-

Relationship/marital conflicts

-

Stress, anxiety and depression

-

Work/school disagreements

-

Substance abuse

-

Child and elder care referral services

The service includes unlimited telephonic support, and up to 3 face-to-face emotional or work-life counseling sessions per occurrence per year, so each member of your family can get counseling help for their own unique needs. Legal and financial counseling are also available by telephone during regular business hours.

EstateGuidance Will Services

Secure the future of your family with ease by utilizing EstateGuidance's will preparation services offered through The Hartford. EstateGuidance assists you with the creation of a legally binding will, supported by licensed attorneys available for online assistance.

Simply follow the step-by-step instructions provided on the platform. To get started, visit www.estateguidance.com. When prompted, use the code WILLHLF to create your will.

Financial Information and Resources

Provides support for the complicated financial decisions you or your family members may face. Speak by phone with a Certified Public Accountant and Certified Financial Planner ™ Professionals on a wide range of financial issues. Topics may include:

-

Managing a budget

-

Retirement

-

Getting out of debt

-

Tax questions

-

Saving for college

Legal Support and Resources

Offers assistance if legal uncertainties arise. Talk to an attorney by phone about the issues that are important to you or your family members. If you require representation, you’ll be referred to a qualified attorney in your area with a 25% reduction in customary legal fees thereafter. Topics may include:

-

Debt and bankruptcy

-

Guardianship

-

Buying a home

-

Power of attorney

-

Divorce

Health Champion

A service that supports you through all aspects of your health care issues by helping to ensure that you’re fully supported with employee assistance programs and/or work-life services. HealthChampion is staffed by both administrative and clinical experts who understand the nuances of any given health care concern. Situations may include:

-

One-on-one review of your health concerns

-

Preparation for upcoming doctor’s visits / lab work / tests / surgeries

-

Answers regarding diagnosis and treatment options

-

Coordination with appropriate health care plan provider(s)

-

An easy-to-understand explanation of your benefits – what’s covered and what’s not

-

Cost estimation for covered / non-covered treatment

-

Guidance on claims and billing issues

-

Fee / payment plan negotiation

Travel Assistance

The Hartford also provides a Travel Assistance benefit which gives you access to resources while traveling. When the unexpected happens far from home, it is important to know whom to call for assistance. With a presence in 200 countries and territories around the world, they are available to help anywhere, anytime.

What to have ready. Your employer's name, a phone number where you can be reached, nature of the problem, Travel Assistance ID number (GLD-09012), and your company policy number.

Have a serious medical emergency? Obtain emergency services first, and then contact Europ Assistance USA to alert them to your situation.

Retirement & Savings

The Whitfield County Schools retirement program is made up of multiple parts: Social Security and either the Teachers Retirement System (TRS) or the Public School Employees Retirement System (PSERS), and the Whitfield County Schools personal retirement plan options in a supplemental 403(b), 457(b), or Roth IRA plan.

Whitfield County Schools also offers an optional 529 plan college savings fund for all employees. This plan has federal and state tax advantages that help you maximize savings for children and grandchildren.

Teachers Retirement System (TRS)

The Teachers Retirement System (TRS) is a defined benefit plan, meaning participants are guaranteed a set monthly retirement income from the plan. Eligible positions include: Certified Teachers, Administrators, Clerical Staff, Paraprofessionals, Lead Custodians, and School Nutrition Managers.

How Does It Work? All TRS employees contribute 6% of gross salary to TRS through monthly payroll deduction. In addition, Whitfield County Schools contributes 21.91% to each TRS employee’s retirement account monthly.

TRS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit at the:

Completion of 10 years of creditable service and attainment of age 60.

Completion of 30 years of creditable service, regardless of age.

Completion of 25 years of service and before age 60, but with a permanently reduced benefit.

The amount you will receive at retirement is based on 2%, multiplied by your years of creditable service, multiplied by the average of your highest consecutive 24 months of pay.

Example:

2% x 30 years = 60%

Average of highest 24 consecutive months of pay = $70,000

60% x $ 70,000 = $ 42,000 / year

You may contact TRS at (800) 352-0650 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online. A link to the TRS Member's Guide is located in the Resources section.

Public School Employees Retirement (PSERS)

The Public School Employees Retirement System (PSERS) is the retirement system for public school employees who are not eligible to participate in TRS. This is also a defined benefit plan, so participants are guaranteed a set monthly retirement income. PSERS retirement income supplements income from Social Security for all employees in a permanent position, employed half time or more. Positions include: Maintenance and Custodial Staff, School Nutrition, Bus Drivers and Monitors, Transportation, and Warehouse staff.

How Does It Work? Participants in PSERS hired before 7/1/2012 contribute $4 monthly for a 9-month contribution period of September through May each year. Employees hired after 7/1/2012, without prior PSERS qualifying service, contribute $10 monthly for the 9-month period.

PSERS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit at the:

- Completion of 10 years of creditable service and attainment of age 60, at a permanently reduced benefit.

- Completion of 10 years of creditable service and attainment of age 65 with full benefits.

The amount you receive in retirement is based on your years of creditable service multiplied by a set dollar amount. The current amount set by the Georgia General Assembly is $17.00.

For example, an employee with 30 years of creditable service would receive a monthly benefit based on the calculation of $17.00 X 30 years of service = $510.00 per month.

You may contact PSERS at (800) 805-4609 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online by registering and logging into your PSERS account. You can also view the virtual PSERS Employee Handbook.

403(b) and 457(b) Retirement Savings Plans

The personal retirement plans can help employees supplement their state retirement plan by offering enrollment in a 403(b), 457(b), or Roth IRA. These plans are available to all employees, and you may save pre-tax dollars in funds managed by Corebridge Financial, Modern Woodman, or ValuTeachers.

457(b) Retirement Savings Plan

In determining if a 457(b) Roth account is right for you, we encourage you to carefully assess the advantages and disadvantages. A 457(b) Roth may appeal to those who:

- Cannot contribute to a Roth IRA due to income limits

- Are young and in lower income tax brackets than they expect to be in retirement

- Are financially stable, but expect tax rate increases

- Want tax diversity and flexibility in retirement

403(b) Retirement Savings Plan

A Roth account can be a way to boost your savings or reduce your taxable income in the future. The account will allow you to set aside after-tax money, and after five years, make tax-free withdrawals of principal, interest, and earnings if certain conditions are met.

Voluntary Roth IRA Retirement

A Roth IRA is a voluntary retirement plan option available to all employees. Below are some features of this plan.

-

Potential for tax-free withdrawals at retirement

-

No required minimum distributions at age 70 ½

-

Contributions are not subject to income taxes when they are withdrawn

-

Potential for beneficiaries to receive income tax-free withdrawals after your death

Contribution Limits

- Under Age 50: $5,500

- Age 50+ :$6,500

College Saving Plan: Path 2 College

It’s never too early to prepare your child or grandchild for a successful future. The Path2College 529 Plan is flexible, affordable and includes great tax advantages that help you save more of your hard earned money.

-

Optional 529 Plan college savings fund available for all employees

-

Federal and state tax advantages that help you maximize savings

-

Available for children and grandchildren

-

Compounded earnings potential works to help grow your balance over time

Planning to Retire?

For more information on your retirement options, please review the SHBP Retirement Presentation available here.

Flexible Spending (FSA)

Flexible Spending Accounts (FSA) allow you to designate a set amount of money and have it taken out of each paycheck and deposited into an account to be used for specific expenses. Federal Income and Social Security taxes will not be withheld from your contributions, making your taxable income lower. You may enroll in the Healthcare FSA for medical, dental, vision, pharmacy, and other related expenses, and / or the Dependent Care FSA, primarily for dependent day care expenses. Use the money in these accounts to pay for eligible out-of-pocket healthcare (medical, dental, vision expenses) and dependent care (day care) expenses for yourself, your spouse, your children or for any person you claim as a dependent on your federal income tax return.

Healthcare FSA accounts are limited to $3,300 per year per employer for 2025. For 2026 the healthcare FSA will have an annual contribution of $3,400. If you're married, your spouse can contribute up to the max their employer allows as well.

For Dependent Care FSAs, you may contribute up to $5,000 for 2025 if you are married and filing a joint return, or if you are a single parent. If you are married and filing separately, you may contribute up to $2,500 per year per parent for 2025. For 2026, single individuals and married couples filing jointly may contribute up to $7,500, and for married individuals filing separate returns, the limit is $3,750.

Remember to carefully estimate your plan year expenses when making an election. You must use all of the funds in your account by the end of the plan year or the money is forfeited per the IRS regulations.

The debit card provides a convenient way to pay for eligible expenses, thus eliminating the need to pay out of pocket, file claims, and be reimbursed. Medcom may request receipt documentation for your debit card transactions. Remember to retain all receipts, per IRS guidelines. Not all providers accept the FSA debit card, and for those providers who do not, you will pay at the time of transaction and complete a claim form to request reimbursement.

The IRS requires that any unused money in your account at the end of the plan year must be retained by your employer. Be sure to use the entire amount of your FSA balance in order to avoid forfeitures.

2025 Plan Year Maximums

- Healthcare FSA: $3,300

- Dependent Care FSA: $5,000

2026 Plan Year Maximums

- Healthcare FSA: $3,400

- Dependent Care FSA: $7,500

FSA plan participants will pay a monthly administration fee of $3.45, which will be a separate payroll deduction post-tax. There are no duplicate fees if you are enrolled in both the Healthcare and Dependent Care FSA.

Healthcare FSA

Claims must be incurred within 2 ½ months following the last day of the plan year (by March 15, 2026 for the 2025 plan year) in order to be eligible for reimbursement. All 2025 FSA claims must be submitted to the FSA administrator by April 30th, 2026 in order to be considered for reimbursement.

Over-the-counter (OTC) drugs are available without requiring a prescription. Some examples of allowed OTC items are:

- Cough medicines

- Cold medicines

- Allergy medicines

- Pain relievers, such as acetaminophen

A list of eligible vs ineligible expenses is available on the Resources page.

Dependent Care FSA

If your spouse is not employed, your dependent care expenses are not eligible for reimbursement unless your spouse is a full-time student or is physically or mentally incapable of caring for himself / herself.

Eligible Dependent Care FSA expenses include before and after-school programs, licensed day care centers, nursery school or preschool, summer day camps, transportation to and from eligible care, an adult-day-care center, or elder care (in your own home or someone else’s). You can elect a Dependent Care FSA even if you have declined health coverage

Eligible childcare providers can be individuals, such as a family member or friend. However, it's important to note that this category excludes individuals under the age of 19 who are related to you, including your own child or stepchild. Additionally, the caregiver cannot be someone whom you list as a dependent on your federal tax return.

To claim reimbursements for dependent care through this FSA, you must ensure that the service provider has either a federal tax ID number or a valid social security number. This documentation is essential to facilitate the reimbursement process.

Claims must be incurred within 2 ½ months following the last day of the plan year (by March 15, 2026 for the 2025 plan year) in order to be eligible for reimbursement. All 2025 FSA claims must be submitted to the FSA administrator by April 30th, 2026 in order to be considered for reimbursement.

Eligible Expenses Must Be for the Care of:

- A dependent child who is under age 13 and whom you claim as an exemption on your tax return

- A dependent child, elderly parent, or relative who is physically or mentally incapable of caring for himself or herself

How It Works

You will either use your debit card to pay for claims at the point-of-service, or submit a claim to the administrator for reimbursement.

Debit Card Purchases

You will receive a debit card for your FSA plan. This debit card may be used to pay for eligible medical care expenses. Using a debit card is a convenient way to pay for your FSA expenses as many health providers accept the debit card. When you use your debit card, the funds are pulled from your account and paid to the health provider directly. This eliminates the need for you to pay out-of-pocket and file a claim to be reimbursed.

Please remember to keep all FSA claim receipts, even if you use your debit card. Some debit card claims will require you to provide a receipt to the plan administrator. In the event the FSA administrator needs additional information from you, you will receive a communication requesting receipt(s).

Manual Claims

Not all vendors accept the debit card. Should you need to pay for an eligible expense and be reimbursed from your FSA, you will need to submit a claim to the address indicated on the claim form with appropriate documentation.

Mobile and Online Member Tools

Once you are enrolled, you may access www.medcombenefits.com and register as a member. You may access your balance and claims information, and view other important FSA plan information on this website.

Medcom also offers a free mobile app for FSA participants to access your accounts from anywhere at any time. You will enjoy convenient mobile options to check balances, view transaction details, request a reimbursement, and submit documentation on the go.

Identity Theft

Whitfield County Schools offers Identity Theft protection through ID Watchdog. While most of us wouldn't dream of leaving our house or car unlocked, it's surprising how often we leave our personal and financial information vulnerable. Without a watchful eye, your credit cards, bank accounts, personal details, and reputation can end up in the wrong hands. Don't become the cybercriminals' next victim. Protect yourself and your family with award-winning credit and identity monitoring including up to $2 million in ID Theft Insurance. ID Theft Insurance helps pay certain out-of-pocket expenses in the event you’re a victim of identity theft.

ID Theft Protection is designed to help you regain control of your name and finances after identity theft occurs. Trained counselors walk you through the process of remediating any damage. They help you write letters to creditors and debt collectors, place a freeze on your credit report to prevent an identity thief from opening new accounts in your name, and guide you through the restoration process.

Summary of Benefits

- Identity Theft insurance for certain out of pocket expenses: $2m

- Up to $2m stolen funds reimbursement

- Reimbursement for home title fraud, cyber extortion, professional identity fraud, deceased family member fraud

- Lost wallet and vault assistance

- Credit freeze assistance

- Credit report lock

- Blocked inquiry alerts

- Child credit lock

- Subprime loan block

- Integrated Fraud Alerts

- Customizeable Alert Options

- Accounts Monitoring for financial, credit, loan, and social accounts

- Registered Sex Offender Reporting

- Digital Identity and Device Protection Tools

- Identity Restoration

- Cyber crime coverage, including online fraud reimbursement, extortion and ransomware attacks, and counseling for cyberbullying

Additional Plan Benefits include:

- Mobile app: keep a pulse on your personal and financial information by accessing key plan features right from your mobile device.

- 24/7/365 Customer Care: reach an in-house U.S.-based customer care advocate whenever you need help.

Wellness

Sharecare, the wellness program vendor, provides comprehensive well-being and incentive programs for SHBP members. As you complete wellness activities and earn Well-Being Incentive Points, these points are saved in the Sharecare Redemption Center until you choose to redeem them.

All employees and covered spouses are eligible to receive Well-Being Incentive points for completion of activities between January 1 and December 1. These points offset your medical and pharmacy expenses.

You and your spouse may earn 120 points for the RealAge Test and 120 points for the Biometric Screening. For 2026, members earn 40 points for preventive screenings and 30 points for coaching and online challenges. Once you have completed your Well-Being Assessment, you may participate in telephonic coaching or online tracking to earn additional points. For telephonic coaching, you can earn 40 incentive points for 1 call in a calendar month, up to 6 calls a year. You may also record items such as exercise and food servings on the Well-Being Connect portal and earn additional points. For online trackers, you can earn 40 points for the same trackers 5 times in a calendar month up to 6 times a year.

You and your spouse may earn a combined total of up to 960 in Well-being Incentive points. Incentive points will rollover, regardless of the option selected for the new year.

High Deductible Health plan members must meet a portion of your deductible before you are able to use your well-being incentive points. You must meet $1,650 for individual coverage and $3,300 for dependent coverage before wellness points are available. United Healthcare is matching the first 240 in well-being incentive points for employees and spouses.

Additional information on the program can be found by clicking here. A calendar of local biometric screening events is available here.

Steps to Wellness

Well-Being Incentive points are earned for completing activities during the plan year. Below are the steps to take to start earning!

- Real Age Test: A confidential, online questionnaire about your health

- For 2026, members earn 40 points for preventive screenings and 30 points for coaching and online challenges.

- Biometric Screening: Assesses your health

- Take Action with Coaching or Online Pathway: Phone coaching can earn you 40 points for one call in a calendar month up to 6 times / year. Online Pathways can earn you up to 120 points within a 90 day period. You can complete two events, for a maximum of 240 points.

Redemption Options

Employee and covered spouses can redeem well-being incentive points in one of two ways:

-

480 well-being incentive credits towards eligible medical and pharmacy expenses (can be redeemed in increments of 120 points to HIA, HRA or MIA) OR

- A $150 Visa Reward Card that can be used anywhere Visa is accepted (expires one year after redemption)

Members need to go to the ShareCare website to choose the redemption option preferred. If members select to use the credits towards eligible expenses, the HMO reimbursement is done by check, and HRA credits are used at the point of service.

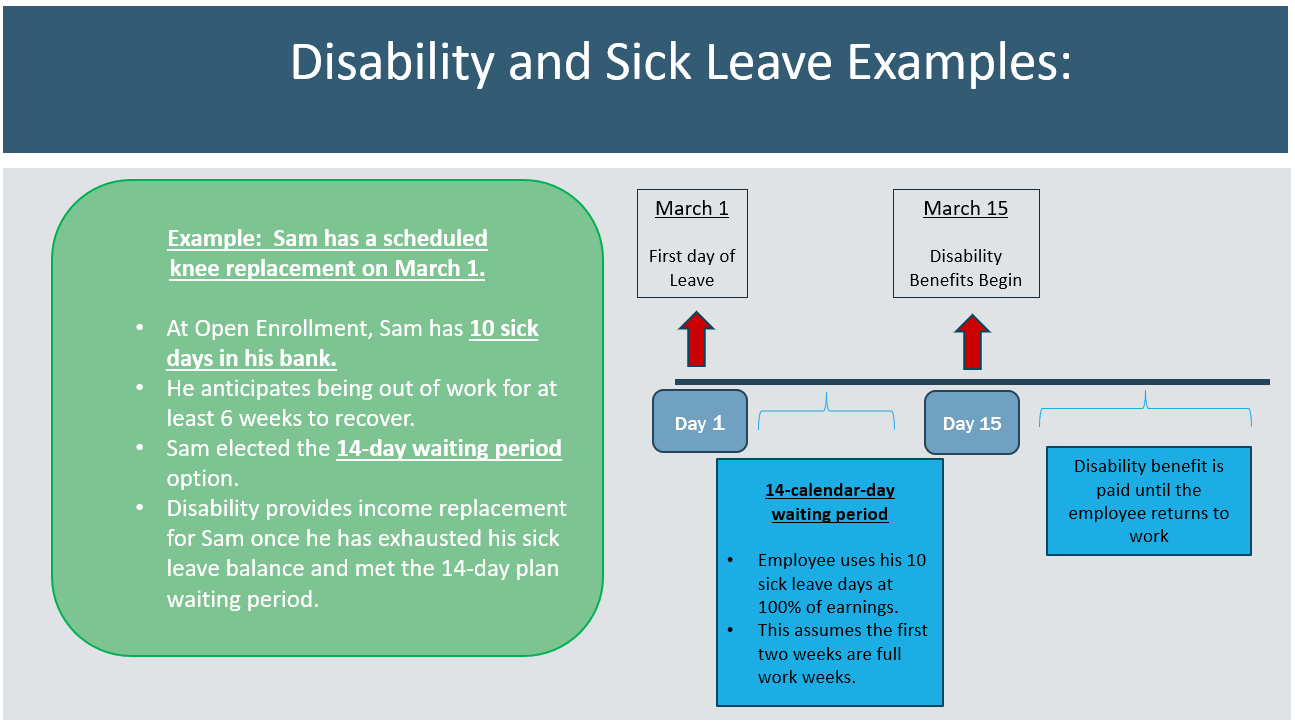

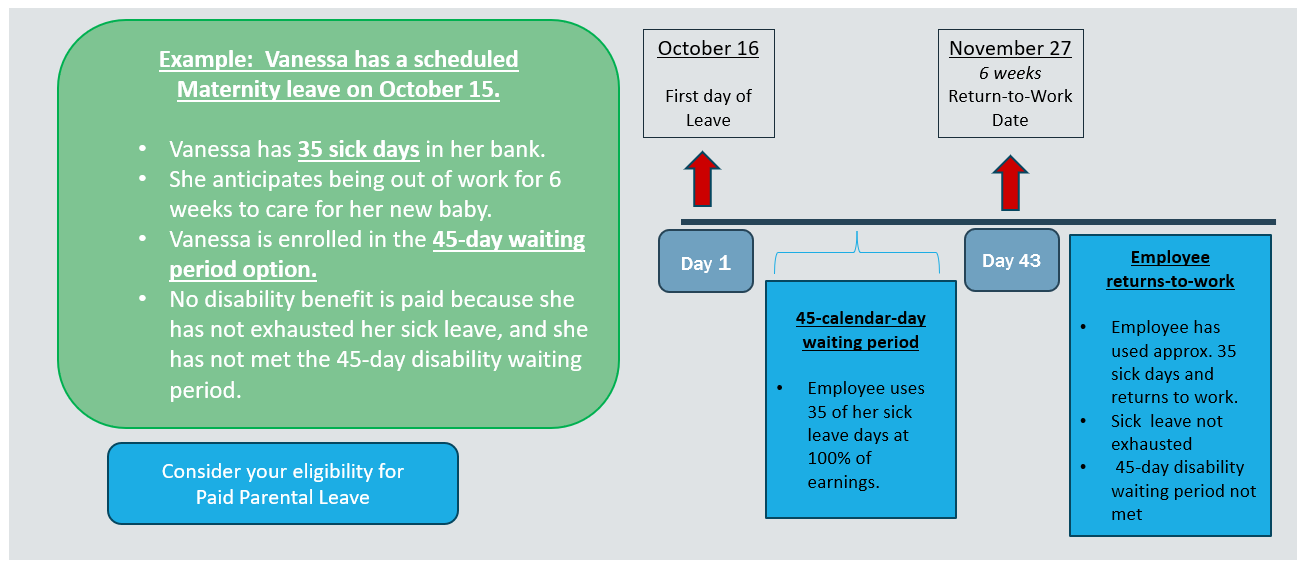

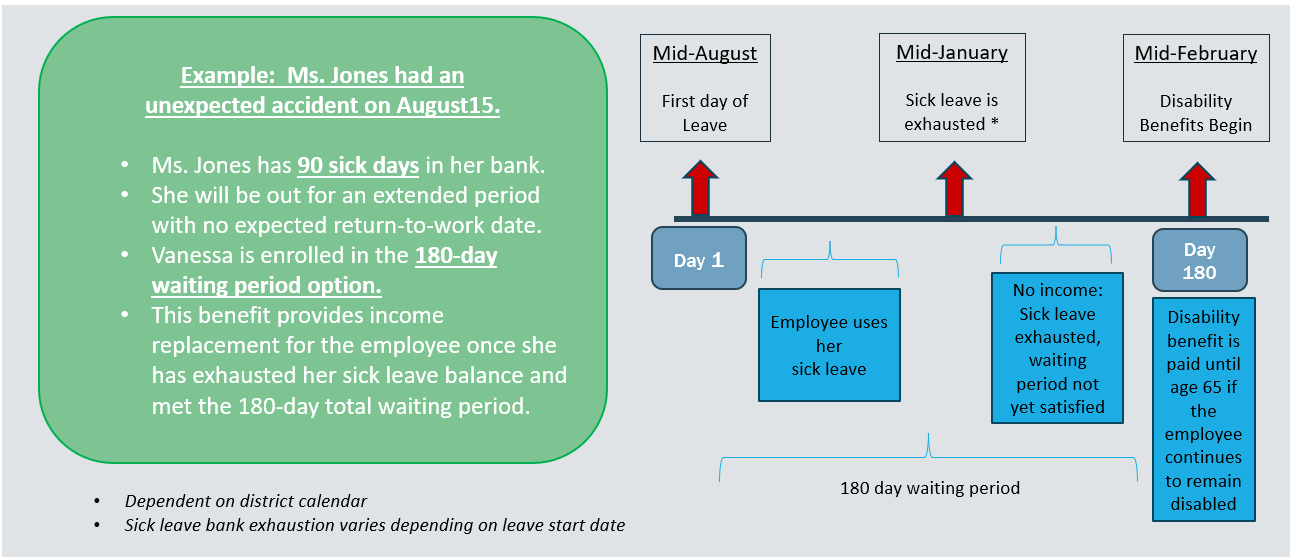

Sick Leave & Disability

The Board enables employees to accumulate "sick leave" days, for which you will receive full pay if you are injured or ill and cannot work. With consistent attendance and increased tenure, you may accumulate up to 90 days of sick leave credit. Sick leave must be exhausted before the disability benefit begins.

Disability coverage provides an income replacement benefit once your sick days are exhausted. You may choose from 7 different waiting periods: the shortest waiting period is 7 days, and the longest is 180 days. Sick days will reduce your elimination period in the event of disability. You may also choose any monthly benefit amount in increments of $100, from $400 up to $7,000, not to exceed 60% of your monthly earnings. The longer the benefit waiting period, the lower the premium. Benefits are available up to age 65 (or normal retirement age) if you remain disabled.

Pre-Existing Conditions

12 Month Pre-Existing Condition Exclusion

The plan pays a limited benefit for disabilities caused by pre-existing conditions during the first 12 months of disability coverage.

A pre-existing condition is a sickness or physical condition for which you have been diagnosed or treated during the immediate 6 months prior to your coverage effective date.

You may elect up to the maximum benefit as a new hire with no health questions. Future increases in coverage will be subject to the pre-existing condition limitation.

Expectant Mothers

A “normal delivery” is the only situation in a disability plan where there is a pre-set benefit period: 6 weeks after delivery. This does not mean that you will receive 6 weeks of payment from the disability plan. Sick leave will be used first, then, if you have met the waiting period you selected, the plan will pay benefits for the remainder of the 6 week period. If you deliver by C-section or complications require you to be out longer, benefits can extend beyond the 6-week period.

Disability & Sick Leave Considerations

You’re able to accumulate up to 90 days of sick leave for which you will receive full pay if you’re injured or ill and unable to work. You may enroll in the disability plan which provides an income replacement benefit once your sick leave days are exhausted. You may choose your monthly benefit amount and when you would like your benefit to start. Below are some key things to remember when evaluating your disability options:

- Consider your sick leave balance when making your disability plan election.

- To avoid overpaying for your disability plan benefit, be sure to choose a waiting period option that exceeds your sick leave balance.

- Depending on the dates and duration of your leave, and your accrued sick leave days, you may have a gap between your sick pay and when the disability benefit begins. Work days are used for your sick leave exhaustion, and calendar days are used for the disability plan waiting period.

Below are a few examples of sick leave combined with disability coverage. To reiterate, the benefit start date and sick leave exhaustion depend on the specific dates of your leave of absence.

-

Benefits are payable up to age 65

-

If age 66-69, there is a limit of benefit duration; more information is available in the SPD on the Resources page

-

-

Disability plans are not portable

Group Legal

Studies show that seven out of ten employees experience one or more legal events in a year. We are pleased to offer a group legal plan that will help cover the costs of legal expenses associated with a variety of needs, including document preparation and review, family law, estate planning, traffic offenses, and more!

Whitfield County Schools employees may enroll in the ARAG legal plan and access a variety of legal benefits. Covered services are covered in full at a participating attorney. Telephone advice and office consultations with a network attorney are covered in full on an unlimited number of personal legal matters. Trials for covered matters are also covered from beginning to end.

ARAG provides you with telephone and office consultations for an unlimited number of matters. Attorney fees are paid in full when using an in-network attorney. During the consultation, the attorney will review the law, discuss your rights and responsibilities, explore your options and recommend a course of action. Emergency service with an attorney is even available 24 hours a day / 7 days a week. The ARAG Legal Center, an online resource with information and education, is available for all Whitfield County Schools employees, regardless of enrollment in the legal plan.

Telephone and Office Consultations

- Consultations for an unlimited number of matters with an attorney

- During the consultation, the attorney will review the law, discuss your rights and responsibilities, explore your options, and recommend a course of action

- Trials for covered members are covered from beginning to end

All legal plan members have access to wills, durable power of attorneys, and other related documents at no cost via the two options below.

- Access an in-network provider – no cost / covered in full

OR

- Use your member login and access DIY online documents. With this option, you can complete a simple process online at no cost.

Participating Attorneys

When a participating attorney is used, services are covered at 100%.

A participating attorney list is available on the Resources page or by visiting http://www.ARAGlegal.com/plans?access_code=18471wcs.

Available Coverages

-

Disputes over Consumer Goods and Services

-

Small Claims Assistance

- Administrative Hearings

- Civil Litigation Defense

- Incompetency Defense

- Pet Liabilities

- School Hearings

- Affidavits; Deeds; Demand Letters

- Mortgages

- Promissory Notes

- Review of Any Personal Legal Documents

- Consultations and Document Review for issues related to your parents including Medicare, Medicaid, Prescription Plans, Nursing Home Agreements, Leases, Notes, Deeds, Wills and Powers of Attorney as these affect the Participant

- Codicils

- Healthcare Proxies

- Living Wills

- Powers of Attorney (Healthcare, Financial, Childcare)

- Simple and Complex Wills

- Trusts (Revocable and Irrevocable)

- Adoption and Legitimization

- Guardianship or Conservatorship

- Name Change

- Prenuptial Agreement

- Protection from Domestic Violence

- Divorce (contested and uncontested)

- Debt Collection Defense

- Foreclosure Defense

- Identity Theft Defense

- Negotiations with Creditors

- Personal Bankruptcy

- Tax Audit Representation

- Tax Collection Defense

- Advice and Consultation

- Preparation of Affidavits and Powers of Attorney

- Review of Immigration Documents

- Juvenile Court Defense, including Criminal Matters

- Parental Responsibility Matters

- Defense of Traffic Tickets (excludes DUI)

- Driving Privilege Restoration (Includes License Suspension due to DUI)

- Assistance for disputes over goods and services

- Consultations and Document Review for Personal Property Issues

- Boundary or Title Disputes

- Eviction and Tenant Problems (Primary Residence - Tenant Only)

- Home Equity Loans (Primary, Secondary or Vacation Home)

- Property Tax Assessment

- Sale, Purchase or Refinancing (Primary, Secondary or Vacation Home)

- Security Deposit Assistance (For Tenant)

- Zoning Applications

When a participating attorney is used, services are covered at 100%. A participating attorney list is available on the Resources page or by visiting https://www.araglegal.com/plans and entering the code: 18471wcs.

Legal Videos

All About Your Legal Insurance Webinar

Learn more about what legal insurance is and how ARAG legal insurance works.

DIY Docs® from ARAG®

With DIY Docs it's easier than ever to create more than 350 legally valid documents online that you can store, update and print - anytime.

5 Steps to Follow When Creating Your Estate Plans

4 Steps to Fighting a Traffic Ticket

Life Insurance

We are proud to offer a district-paid basic life insurance benefit of $15,000 to all benefits-eligible employees. This coverage ensures financial support for your loved ones in the event of your passing. Insured by The Hartford, this benefit comes at no cost to you and does not decrease as you age.

In order to provide you and your family with additional financial protection in the event of your death, Whitfield County Schools offers voluntary term life insurance for employees, your spouse, and your child(ren) through The Hartford. The plan includes Accidental Death and Dismemberment coverage, or AD&D. If you pass away as a result of an accident, the plan also pays either the amount of your life insurance or a percentage for loss of limbs, speech, hearing, and more.

Beneficiaries

You will be required to provide your beneficiary information at the time of your enrollment. A beneficiary is a person who would receive your life insurance benefit in the event of your death.

Evidence of Insurability (EOI)

As a new hire, you are able to elect up to the Guarantee Issue of $150,000 for yourself, $50,000 for your spouse, and $10,000 for your child(ren) with no health questions. Should you wish to elect an amount that exceeds the Guarantee Issue, an Evidence of Insurability Form is required. You may obtain an EOI Form from the Resources page or by calling the Benefits Service Center. Most new and additional elections at Annual Open Enrollment also require an Evidence of Insurability (EOI). To apply, simply complete the form and submit it to The Hartford for review. You will not be deducted for your pending amount unless / until you are approved.

Board-Provided Life Insurance

Whitfield County Schools provides all eligible employees a $15,000 life benefit at no cost to you.

Voluntary Life & AD&D Insurance

You may elect voluntary life insurance for yourself and your dependents through payroll deduction to supplement the basic life benefit.

Plan Maximums

Employee Life: Up to 5x earnings in $10,000 increments to a maximum of $300,000

Spouse Life: Up to 100% of employee amount in $10,000 increments to a maximum of $100,000

Child Life: $10,000 coverage up to age 26

Guarantee Issue Amounts

Employee Life: $150,000

Spouse Life: $50,000

Child Life (15 days to 6 months): $100

Child Life (6 months - 26 years): $10,000

Important Notes

- There is no age cap to be eligible to enroll.

- Common law spouses and domestic partners are not eligible for spouse life coverage.

- Spouse life cannot exceed 100% of employee amount.

- Rates are age banded and spouse life rates are based on spouse's age.

- Child(ren) can be covered only until age 26.

- Beneficiary information is required upon enrollment.

- Accidental Death and Dismemberment (AD&D) coverage is included with the Voluntary Life Insurance. The Voluntary Life Insurance benefit is double if the cause of death is due to a covered accident, per policy details.

- If you are married to another WCS employee:

- You must elect Employee Life only (no Spouse Life coverage is available).

- Only one employee can cover the child(ren); no duplicate coverage is allowed.

Portability and Conversion

You may have the opportunity to continue your life insurance benefit should you separate employment with Whitfield County Schools if certain conditions are met. Portability allows you to continue coverage with an individual term life insurance policy. Conversion allows you to continue coverage with an individual permanent whole life insurance policy. Your application to port and/or convert coverage must be submitted to The Hartford within 31 days of your coverage termination date.

Basic Life Insurance is eligible for the conversion option only.

Employees may port Supplemental Life and Supplemental Dependent Life Insurance. An employee must be under Social Security Normal Retirement Age to be eligible for the portability option. Portability life insurance coverage ends at age 75. An employee who is at or above Social Security Normal Retirement Age is eligible for the conversion option only.

Additional information regarding these two options may be obtained by contacting The Hartford or by visiting the Resources page.

Dental

Whitfield County Schools offers three dental plan options with MetLife: Base, Standard, and Premium. All options include preventive care at 100% (no deductible). The Base Plan option has the lowest premiums and lowest annual maximum benefit, with coverage for preventive and basic services only. The Standard Plan is the “mid-level” plan, with coverage for major services but no coverage for orthodontic care. The Premium Plan is the richest option, with coverage for orthodontia, the highest maximum benefit, and a lower deductible.

Preventive care, or Type A services such as cleanings, exams, and x-rays are covered on all three plan options at 100% with no deductible. Type B services include but are not limited to fillings, simple extractions, and periodontal scaling and root planing You pay a deductible first, and then the plan pays 80% coinsurance. Major or Type C services like bridges, crowns, and root canals are covered at 50% after the deductible on the Standard and Premium plans. Orthodontia is covered at 50% up to a $1,500 lifetime maximum on the Premium plan only.

As long as you access a MetLife PDP Plus dental network provider, your claim will be processed at the in-network level with no balance billing. Services not covered or that exceed the calendar year maximum are the patient’s responsibility.

We encourage you to use a MetLife PDP Plus provider in order to maximize your dental plan benefits. Access www.metlife.com/dental to locate participating dental provider information. Refer to the dental benefits summary for complete details regarding frequencies and coverage information. Participating dentist information can be found on the Resources page.

Below is a benefit summary of your annual deductible and co-insurance costs.

| MetLife Dental Coverage | Base Plan | Standard Plan | Premium Plan |

|---|---|---|---|

|

Deductible

|

$75 Individual $225 Family |

$75 Individual $225 Family |

$50 Individual $150 Family |

|

Type A - Preventive Services (Deductible Waived): Cleanings, exams, fluoride, x-rays (including full mouth), sealants and more

|

Plan pays 100% | Plan pays 100% | Plan pays 100% |

|

Type B - Basic Services (After Deductible): Fillings, simple extractions, general anesthesia, periodontal scaling, and root planing.

|

Plan pays 80% | Plan pays 80% | Plan pays 80% |

|

Type C - Major Services (After Deductible): Periodontal surgery, major periodontics, bridges, dentures, crowns, and root canals.

|

Not Covered | Plan pays 50% | Plan pays 50% |

|

Type D - Orthodontia (After Deductible): Adults and children

|

Not Covered | None | Plan pays 50% |

|

Orthodontia Lifetime Maximum

|

None | None | $1,500 per person |

|

Annual Maximum (per person)

|

$750 per person | $1,000 per person | $2,000 per person |

Important Notes

- Deductible (waived for preventive); differing annual maximums depending on plan

- Members utilizing MetLife participating dentists will enjoy discounted dental fees in addition to protection from balance billing for charges above the dentist’s maximum allowable charges. Members utilizing non-participating dentists will have the same benefits, but may be subject to balance billing.

Claims Process

In-Network

- Participating MetLife dentists file the claim and accept payment from MetLife

- Employees should not need to pay at the time of service for participating providers

Out-of-Network

- For out-of-network dentists, if the dentist does not agree to file the claim as out-of-network with MetLife, employee pays at the time of service and files a claim for reimbursement

- Charges by out-of-network providers that exceed Usual & Customary are the member’s financial responsibility. (Member pays the difference between the actual charge and the plan’s U&C reimbursement level.)

Virtual Dental Care

The MetLife Dental Plan offers virtual dental care for times when you're in pain or unable to visit a dentist in person. You can consult with a licensed dentist through a video call. Simply log in to your MyBenefits Account at online.metlife.com, and choose "Start Virtual Visit" to begin.

State Health Benefit Plan (SHBP)

The State Health Benefit Plan (SHBP) is established for the benefit of school districts and other governmental employers by the Georgia legislature. SHBP operates through the Georgia Department of Community Health (DCH). SHBP and DCH determine the plan design, the monthly premiums, and the network providers. Whitfield County Schools provides payroll deduction for your premium along with other administrative support. A Decision Guide is available for plan details, and the monthly premiums are available in the Premiums section.

There are two health plan carriers available to you, and multiple plan options under those carriers.

Anthem offers four plan options: three HRA plans and one HMO plan. The HMO plan option provides in-network coverage only, and requires copays for many services.

UnitedHealthcare offers an HMO similar to the Anthem plan, along with a High Deductible Health Plan (HDHP). The HDHP has the highest deductible and out-of-pocket costs, but the lowest premiums.

Whitfield County Schools pays a significant portion of your health insurance premiums. This financial contribution reduces your premium for a quality health plan at a competitive cost.

Anthem Plan Options

The Anthem plans include Gold, Silver, and Bronze HRA plan options, and an HMO plan option. On the HRA plan options, most services are subject to a deductible and there are no copays. After you meet your in-network deductible, you pay coinsurance up to the out-of-pocket maximum. For prescription drugs, you pay a percentage of the retail cost. The HRA plans include a plan-funded Health Reimbursement Account to reduce / offset your deductible and pharmacy expenses (unused balances carry forward into new plan years). Preventive care is covered at 100% in-network before the deductible.

The HMO plan option has the lowest deductible out of all plans, but provides in-network coverage only. Some services (office visits, ER visits, and prescription drugs) are covered at 100% after a copay. For most other services, you are responsible for a deductible and coinsurance until you meet your out-of-pocket maximum. Please be aware that copays do not count towards your deductible. Preventive care is always covered at 100% before the deductible.

UnitedHealthcare Plan Options

The UnitedHealthcare plans include an HMO option and a High Deductible Health Plan (HDHP) option. This HMO plan has the same benefits as the Anthem HMO, but utilizes the UHC network. Visit https://www.whyuhc.com/shbp for more information.

The HDHP plan has the lowest premiums, highest deductible, and highest maximum out-of-pocket costs. All services, including pharmacy, are subject to the deductible and coinsurance, and there are no copays with this plan. Once you meet your deductible, you pay coinsurance until you satisfy the out-of-pocket maximum. As with the other State Health plan options, wellness incentive points can be earned by High Deductible Health Plan members. You are eligible to open an HSA if you enroll in the State Health Benefit Plan (SHBP) High Deductible Health Plan (HDHP) and do not have other coverage through 1) your spouse’s employer’s plan, 2) Medicare, or 3) Medicaid. The HSA is not set up through the district and must be established separately.

Pharmacy Benefits

CVS Caremark is the pharmacy vendor for all medical options.

- For the HRA, you pay a percentage of the cost subject to a minimum and maximum per prescription.

- For the HMO plans, prescription drugs are covered at 100% after a copay at participating pharmacies.

- For the High Deductible Health Plan, prescription drugs are subject to deductible and then coinsurance, similar to other medical services.

The pharmacy costs are included in your out-of-pocket maximums, and a mail order benefit for a 90 day supply is also available. Additional information is found in the State Health Decision Guide.

Disease Management Program

Managing chronic health conditions can be challenging, but the State Health Benefit Plan (SHBP) offers support to help ease the burden. Through SHBP's Disease Management Programs, you have access to valuable resources designed to help you better manage conditions like diabetes, asthma, coronary artery disease, and addiction. These programs provide personalized care and guidance, ensuring you stay on track with your treatment while also lowering your healthcare costs.

Certain drug costs are waived if SHBP is primary and you actively participate in one of the Disease Management Programs for diabetes, asthma, coronary artery disease, and/or medications for additction treatment.

To enroll in SHBP’s Disease Management Programs, you can access your SHBP enrollment portal online at mySHBPga.adp.com or contact SHBP Member Services at (800) 610-1863 for assistance.

Transfers from Other Georgia Systems

- If you are transferring from another Georgia school system or state agency with SHBP, you must keep your current medical coverage for the remainder of the plan year.

- No changes are allowed to your SHBP coverage until the next Open Enrollment period, unless you have a Qualifying Life Event (QLE).

Medicare

For active employees with spouses that are enrolled in Medicare and not disabled, SHBP is primary. The spouse is not required to elect Part B (medically necessary services such as outpatient care and preventive care) until the active employee retires. However, the spouse will automatically receive Part A (hospital insurance).

|

Anthem HRA Plan - Gold In | Out |

Anthem HRA Plan - Silver In | Out |

Anthem HRA Plan - Bronze In | Out |

Anthem OR UHC HMO Plan In (No Out-of-Network Coverage) |

UHC HDHP Plan In | Out |

|

|---|---|---|---|---|---|

|

Deductible

|

|||||

|

You

|

$1,500 | $3,000 | $2,000 | $4,000 | $2,500 | $5,000 | $1,300 | $3,500 | $7,000 |

|

You + Child(ren) / Spouse

|

$2,250 | $4,500 | $3,000 | $6,000 | $3,750 | $7,500 | $1,950 | $7,000|$14,000 |

|

You + Family

|

$3,000 | $6,000 | $4,000 | $8,000 | $5,000 | $10,000 | $2,600 | $7,000|$14,000 |

|

Medical Out-of-Pocket Max

|

|||||

|

You

|

$4,000 | $8,000 | $5,000 | $10,000 | $6,000 | $12,000 | $4,000 | $6,450 | $12,900 |

|

You + Child(ren) / Spouse

|

$6,000 | $12,000 | $7,500 | $15,000 | $9,000 | $18,000 | $6,500 | $12,900|$25,800 |

|

You + Family

|

$8,000 | $16,000 | $10,000 | $20,000 | $12,000 | $24,000 | $9,000 | $12,900|$25,800 |

|

Coinsurance (Plan Pays)

|

85% | 60% | 80% | 60% | 75% | 60% | 80% | 70% | 50% |

|

HRA Credits

|

|||||

|

You

|

$400 | $200 | $100 | N/A | N/A |

|

You + Child(ren) / Spouse

|

$600 | $300 | $150 | N/A | N/A |

|

You + Family

|

$800 | $400 | $200 | N/A | N/A |

|

Medical

|

|||||

|

ER

|

Coins after ded | Coins after ded | Coins after ded | $200 copay | Coins after ded |

|

Urgent Care

|

Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

|

PCP Visit

|

Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

|

Specialist Visit

|

Coins after ded | Coins after ded | Coins after ded | $45 copay | Coins after ded |

|

Preventive Care

|

100% | None | 100% | None | 100% | None | 100% | 100% | None |

Telemedicine

The medical plans include a telemedicine benefit, which allows you to speak to a participating doctor from home or work through your smartphone, tablet or computer 24 hours a day / 7 days a week.

You must use in-network providers for coverage to apply. HMO members pay a copay and HRA members pay coinsurance for telemedicine. High Deductible Health Plan members can access this benefit subject to the health plan deductible.

Download the LiveHealth online (Anthem) or the Virtual Visits (UHC) mobile app for convenient access when you need it, and remember to consider using telemedicine for non-complex medical conditions.

More information is available under Resources.

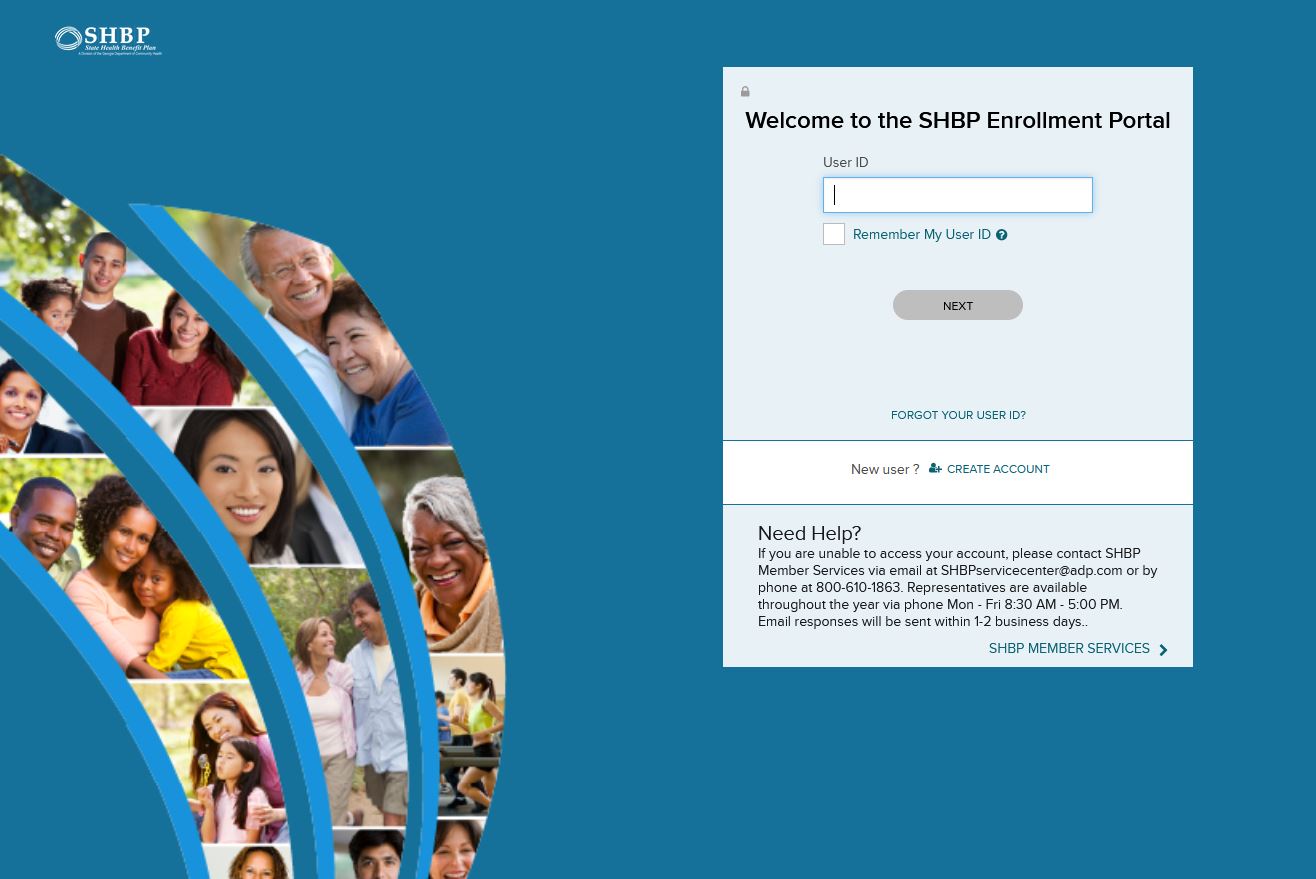

Enrollment - ADP Portal

How to complete your State Health Benefit Plan (SHBP) Enrollment through the ADP Portal.

- Access https://myshbpga.adp.com/shbp to review your health coverage elections. Your registration code is "SHBP-GA."

Dependent Verification

- If you wish to add dependent(s) (spouse and / or children) to your health plan, ADP will contact you (by mail and email) to request appropriate verification documents. If you do not receive the request, contact SHBP directly to have the request sent to you. They can be reached at (800) 610-1863.

- The communication from ADP will include a personalized fax cover sheet with a bar code that must be used when submitting documentation.

- Appropriate documentation must be attached to the fax cover page and provided by the deadline set by ADP.

- Non-verified dependents cannot be added until the next open enrollment period and would require appropriate documentation.

- Additional information can be found on the SHBP website.

Additional Resources

Go Online for More Resources

Access the two following plan websites to locate the participating providers and to find health and wellness tools, plan details, and to print ID cards.

Anthem

Select "Find Care' from the Main Menu and then follow instructions to find a doctor.

UnitedHealthcare

Select "Search for a Provider" under the Benefits drop down. Select "Choice HMO" or "HDHP with HSA" and follow the search instructions.

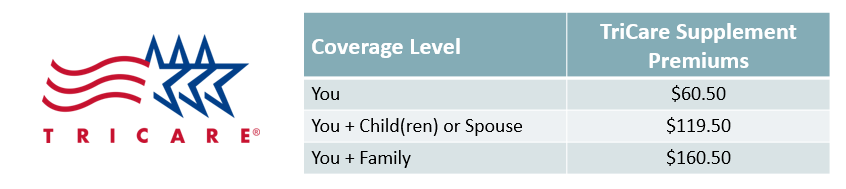

Other Medical Plan Options

TriCare Supplement Plan

The TriCare Supplement Plan is available for retired military employees, and is a supplement to your current TriCare benefits. The plan provides reimbursement of copays and other medical expenses associated with your current TriCare plan. Additional information can be found here.

PeachCare for Kids

The state of Georgia offers an affordable health insurance program called PeachCare for Kids. This plan provides healthcare, dental, and vision benefits for children up to age 19. To learn if you are eligible, and to obtain benefits, cost, and application information, click here.